Sales Team

Project quotes, partnerships, implementation

Selecting a Customer Relationship Management platform has become one of the most strategic technology decisions for modern organizations. The wrong system can trap teams in manual work, fragment customer data, inflate operational costs, and slow growth for years. The right one, however, becomes a revenue engine—connecting sales, marketing, service, analytics, and leadership around a single source of truth.

Yet many executives still approach CRM purchases as software shopping exercises instead of transformation initiatives.

If you are researching how to choose CRM software that can scale with your organization, integrate with existing systems, and support long-term business strategy, this guide is built for you.

In this article, you will learn:

why CRM decisions fail

how to define the right requirements before engaging vendors

which features matter most in 2026

how industry context changes selection criteria

what CRM implementation really costs

mistakes to avoid

and a step-by-step framework to choose the right CRM with confidence

CRM platforms sit at the center of your commercial operations. When selection is rushed or driven by marketing hype, organizations often face:

Low user adoption because workflows do not reflect reality

Manual workarounds that erode productivity

Expensive customizations required after go-live

Disconnected systems across ERP, billing, marketing, and support

Poor forecasting and reporting

Compliance risks in regulated sectors

Replacing a poorly selected CRM two years later is far more costly than investing time upfront to choose the right CRM from the beginning.

That is why mature organizations treat CRM programs as enterprise architecture initiatives, not just IT procurements.

Before reviewing product demos or comparing pricing tiers, leadership teams must reach internal alignment. Many CRM initiatives fail not because the technology is flawed, but because organizations treat selection as a departmental purchase rather than an enterprise transformation.

To choose the right CRM, executives must first clarify what the system is expected to deliver over the next three to five years. Growth plans matter here. Are you expanding into new geographies? Launching new digital channels? Moving toward subscription models or partner-led sales? Introducing automation across operations? Operating in heavily regulated markets?

Each of these strategic directions places very different demands on a CRM platform. A company focused on rapid regional expansion, for example, will need multi-currency support, localization features, and scalable infrastructure. A regulated healthcare provider must prioritize audit trails, access controls, and data residency from day one. Organizations pursuing aggressive digital marketing strategies will depend on deep campaign orchestration and attribution analytics.

When executives ask how to choose CRM platforms that won’t become obsolete, the answer almost always starts with business ambition rather than feature lists.

CRM touches nearly every customer-facing and revenue-generating function. Yet many implementations are driven solely by sales leadership or IT teams. This narrow approach often leads to resistance later, when marketing cannot execute campaigns properly, finance struggles to reconcile revenue numbers, or service teams feel constrained by rigid workflows.

A mature CRM program brings together marketing leaders, customer success managers, operations teams, finance controllers, IT architects, security officers, compliance specialists, and executive sponsors early in the process. Each group views CRM through a different lens: marketing prioritizes segmentation and automation, finance cares about forecasting accuracy, security focuses on governance, and executives want clear dashboards tied to strategic KPIs.

Capturing these perspectives early prevents expensive redesigns after go-live and creates organizational buy-in. When departments feel represented in the decision, adoption rates increase dramatically—a critical factor when attempting to choose the right CRM for long-term use.

Once strategic objectives and stakeholders are aligned, organizations should formalize their needs in a detailed CRM requirements blueprint. This document becomes the foundation for vendor evaluations, demonstrations, and contract negotiations.

Rather than focusing only on today’s workflows, the blueprint should reflect where the organization intends to operate in two or three years. It typically covers core functional requirements such as pipeline management, case handling, marketing automation, and reporting. Just as important are integration needs with ERP systems, billing platforms, HR tools, data warehouses, and customer portals.

Data governance deserves special attention here. Define how customer records are created, updated, archived, and audited. Specify retention policies, regulatory obligations, and access controls. Finally, outline phase-two enhancements—advanced analytics, partner ecosystems, AI capabilities—so vendors can demonstrate roadmap alignment rather than only current functionality.

This disciplined approach removes emotion from procurement and replaces it with evidence-based evaluation—one of the most reliable ways to decide how to choose CRM vendors objectively.

CRM roadmaps evolve constantly, but high-performing platforms consistently invest in a handful of foundational capabilities. Evaluating these areas in depth will prevent costly re-platforming later.

Artificial intelligence has shifted from experimental add-ons to core CRM functionality. Organizations increasingly depend on machine learning to prioritize leads, forecast revenue, flag churn risks, and automate routine engagement.

A modern CRM should allow teams to build intelligent workflows that trigger follow-ups automatically, route cases to the right agents, and surface cross-sell opportunities based on customer behavior. Conversational interfaces—such as chatbots and virtual assistants—extend service availability without increasing headcount, while predictive analytics help executives anticipate market shifts rather than react to them.

When companies upgrade in order to choose the right CRM, AI maturity is often one of the strongest differentiators between platforms that merely store data and those that actively drive growth.

Customers rarely interact through a single channel. They might browse a website, contact support on WhatsApp, respond to email campaigns, and speak to a sales representative—all within the same buying journey.

A CRM platform must consolidate these touchpoints into a unified customer profile, updated in real time and accessible to every department. Without this consolidation, teams operate with partial information, leading to inconsistent messaging and missed opportunities.

Executives evaluating how to choose CRM systems for modern digital operations should look beyond basic contact records and ensure the platform can orchestrate journeys across digital and physical channels at scale.

Every organization has unique approval chains, pricing models, and service workflows. Rigid CRM platforms force teams to adapt to the software rather than the other way around, often resulting in spreadsheets and side systems that undermine data quality.

Leading platforms provide low-code environments that allow administrators to configure pipelines, dashboards, forms, and automation rules without lengthy development cycles. This flexibility underpins CRM Development for Smarter Growth, enabling businesses to experiment with new processes and refine operations as markets evolve.

CRM rarely functions as a standalone application. It must exchange data with ERP systems, accounting software, marketing automation platforms, inventory tools, analytics environments, and partner portals.

A strong API ecosystem—supported by middleware and event-driven architectures—determines how easily data flows across the enterprise. Poor integration design is one of the most common reasons CRM programs underperform.

For organizations investing in long-term CRM Development, integration readiness should carry equal weight to user interface or licensing costs.

Senior leadership increasingly depends on CRM as a strategic intelligence platform. Beyond operational dashboards, executives expect forward-looking insights: pipeline velocity, conversion probabilities, churn forecasts, campaign attribution, and territory performance.

Modern CRM systems embed analytics directly into workflows, eliminating the need for manual exports and spreadsheet reconciliation. AI-driven recommendations help managers act faster, turning data into decisions rather than static reports.

Sector context dramatically changes what “best CRM” means. Organizations that ignore industry realities often struggle post-implementation.

Healthcare providers, insurers, and life-science organizations must emphasize auditability, encryption, data residency, consent management, and interoperability standards such as HL7 or FHIR. Governance features are not optional—they are foundational.

Retail CRM programs depend heavily on integrations with point-of-sale systems, loyalty engines, inventory management, and digital marketing platforms. Real-time data synchronization and customer journey orchestration are critical to delivering consistent experiences across channels.

Manufacturers and industrial distributors often require advanced quoting tools, distributor portals, field sales enablement, ERP synchronization, and contract lifecycle management. CRM becomes the connective tissue between production, sales, and supply chains.

Subscription models introduce new metrics—usage patterns, renewal probabilities, onboarding success, and account health scores. CRM platforms must support recurring revenue logic and predictive churn models to sustain growth.

Industry alignment is frequently what separates successful CRM programs from stalled ones, particularly for organizations evaluating how to choose CRM solutions at enterprise scale.

Rather than comparing dozens of features, use a weighted decision matrix:

| Criterion | Why It Matters |

|---|---|

| Scalability | Supports growth without re-platforming |

| Customization depth | Matches real workflows |

| Integration ecosystem | Avoids data silos |

| Security & compliance | Protects brand and operations |

| Total cost of ownership | Predictable long-term spend |

| Vendor roadmap | Innovation longevity |

| Support model | Reduces operational risk |

This approach brings discipline to efforts to choose the right CRM rather than defaulting to brand popularity.

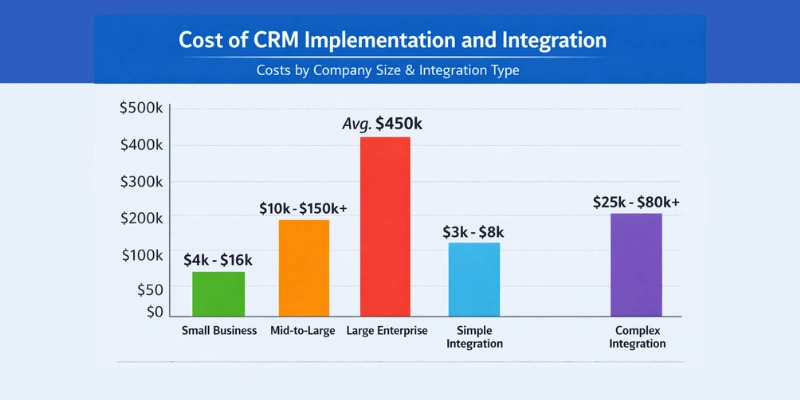

CRM investments extend far beyond monthly license fees. While subscription pricing is the most visible line item, the true cost of ownership emerges from how deeply the platform is customized, how many systems it must integrate with, and how significantly business processes change after adoption.

Organizations evaluating how to choose CRM platforms responsibly should approach budgeting from a total cost of ownership (TCO) perspective rather than a first-year procurement mindset.

Licensing typically scales with user volume, feature tiers, and data storage needs. However, configuration and customization often exceed subscription costs in enterprise environments. Tailoring pipelines, building approval workflows, creating role-based dashboards, and implementing industry-specific modules require architectural design and development effort—especially when the CRM must mirror complex operational models.

Integration work represents another major investment area. CRM platforms frequently sit at the center of an application ecosystem that includes ERP systems, finance tools, marketing automation platforms, inventory software, partner portals, and analytics environments. Developing secure, resilient APIs, implementing middleware, and establishing event-driven data synchronization can demand substantial engineering resources, particularly in regulated or multi-region deployments.

Data migration is frequently underestimated. Cleansing legacy records, de-duplicating contacts, mapping historical transactions, validating regulatory compliance, and performing reconciliation testing all require time and specialist oversight. Poor data migration undermines user confidence from day one—one of the fastest ways a CRM initiative loses momentum.

Training and change management are equally critical cost drivers. Even the most sophisticated platform fails if employees do not adopt it. High-performing programs invest in role-specific training sessions, documentation libraries, internal champions, and post-launch coaching to ensure teams understand not only how to use the system, but why processes have changed.

Security and compliance reviews add another layer of expense, particularly for organizations operating in healthcare, financial services, or multi-jurisdictional environments. Penetration testing, encryption audits, regulatory certifications, access-control frameworks, and data-residency assessments are non-negotiable in enterprise CRM deployments.

Finally, ongoing optimization should be part of long-term financial planning. As markets evolve, organizations refine workflows, introduce new analytics models, expand integrations, and roll out automation across additional departments. CRM is not a one-time project—it is a living platform that evolves alongside the business.

Because of these factors, enterprise CRM implementations frequently reach six-figure budgets and beyond, depending on system complexity, regulatory requirements, geographic footprint, and internal maturity. Organizations that underestimate these elements often face budget overruns or stalled deployments halfway through execution.

Many successful companies mitigate risk through phased rollouts. Rather than activating every module simultaneously, they begin with core sales operations, stabilize data flows, and build adoption before expanding into marketing automation, service management, partner ecosystems, and advanced analytics. This incremental approach spreads investment over time, reduces disruption, and allows leadership to validate ROI before committing to broader expansion—an approach strongly recommended when seeking to choose the right CRM for sustainable growth.

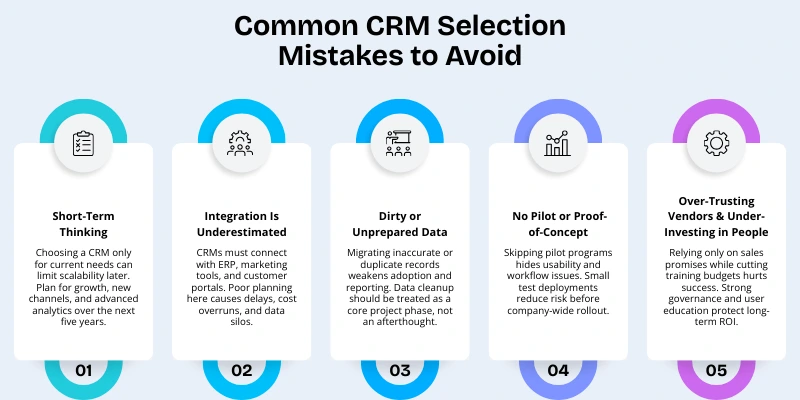

Organizations struggle when they:

buy for today instead of five years ahead

underestimate integration work

ignore data cleanup

skip pilot programs

rely solely on vendor promises

underfund training

neglect governance models

Avoiding these traps dramatically improves long-term ROI when trying to choose the right CRM platform.

Discovery workshops across departments

Process mapping of sales, service, marketing

Data audits and cleansing plans

Vendor shortlisting

Live demos using your scenarios

Pilot projects

Security and compliance reviews

Final commercial negotiations

Phased rollout

Adoption tracking with KPIs

This structured approach removes guesswork from decisions about how to choose CRM systems strategically.

High-impact deployments often focus on:

automated lead qualification

renewal management

upsell triggers

service ticket routing

partner ecosystems

executive dashboards

churn prevention models

You can explore deeper operational examples in CRM Use Cases Every Growing Business Needs, which illustrates how mature organizations transform CRM into revenue platforms rather than static databases.

Off-the-shelf platforms work well for many teams—but not all.

Custom or hybrid CRM solutions become valuable when:

workflows are highly specialized

regulatory requirements are complex

multi-subsidiary structures exist

data sovereignty laws apply

proprietary IP must be protected

Strategic CRM Development programs often blend commercial platforms with tailored modules to create competitive differentiation.

CRM selection is not a procurement exercise—it is an organizational redesign initiative that reshapes how revenue is generated, how customers are served, and how leadership makes decisions.

The organizations that consistently succeed with CRM are not those chasing feature checklists or brand popularity. They are the ones that deliberately align CRM programs with long-term growth strategy, bring cross-functional stakeholders into the process early, architect integrations before signing contracts, and treat adoption as a continuous investment rather than a one-time rollout activity. They establish governance models around data quality and compliance, ensure executive visibility through analytics, and evaluate platforms using objective frameworks instead of marketing claims.

When decision-makers ask how to choose CRM systems that will still serve them five years from now, the answer lies in discipline: disciplined discovery, disciplined architecture planning, disciplined change management, and disciplined vendor evaluation.

By applying the frameworks outlined in this guide—strategic alignment, requirements blueprinting, feature assessment, industry-specific analysis, cost modeling, and phased deployment—you can confidently choose the right CRM for 2026 and beyond. One that supports geographic expansion, digital transformation, regulatory resilience, and customer-centric operations rather than becoming another costly replacement project.

In a market where customer experience increasingly defines competitive advantage, CRM is no longer back-office infrastructure. It is the nervous system of modern growth.

Project quotes, partnerships, implementation

Open roles, referrals, campus hiring