Sales Team

Project quotes, partnerships, implementation

Over the past decade, financial markets have quietly entered a structural transition. Institutional capital is no longer asking whether blockchain has value — it is asking how to integrate it responsibly into existing asset frameworks. At the center of this shift is one question: what is an RWA, and why does it matter now?

An RWA, or real-world asset, refers to any tangible or financial asset that exists outside the blockchain but can be represented digitally. These include real estate, private equity, private credit, commodities, infrastructure funds, treasury instruments, and even receivables. Traditionally, ownership of these assets is recorded through legal contracts, registries, custodians, and centralized intermediaries.

But a second question is rapidly gaining institutional attention: what is RWA tokenization?

RWA tokenization is the process of converting ownership rights in real-world assets into blockchain-based digital tokens. These tokens represent legally enforceable claims on underlying assets and can be programmed with compliance rules, transfer restrictions, and reporting mechanisms. In simple terms, it is the digitization of asset ownership — but with embedded automation and transparency.

To properly understand rwa tokenization explained in depth, we must move beyond hype. This is not about speculative crypto markets. It is about restructuring how assets are issued, administered, and potentially traded within regulated environments.

The tokenization of RWA is not an experimental fringe concept anymore. Major financial institutions are actively exploring tokenized funds, digital bond issuance, and blockchain-based settlement rails. Regulatory bodies such as the International Organization of Securities Commissions have emphasized that digital securities must adhere to the same investor protection frameworks as traditional instruments. That means compliance is not bypassed — it is encoded.

The reason this matters is structural inefficiency.

Private markets — representing trillions in global capital — are often illiquid, administratively heavy, geographically constrained, and dependent on intermediaries for recordkeeping and transfer approval. Settlement cycles can be slow. Cap table management can be manual. Cross-border participation can be complex.

Tokenization introduces a programmable layer.

Instead of relying solely on back-office reconciliation and third-party verification, blockchain-based infrastructures can automate transfer checks, enforce jurisdictional restrictions, and maintain immutable audit trails. Smart contracts act as rule engines, ensuring that each transaction meets eligibility and compliance requirements before it settles.

However, understanding what is an RWA is only the starting point. The more important conversation is whether tokenization meaningfully improves liquidity, transparency, cost efficiency, and investor access — or whether it simply digitizes existing inefficiencies.

This guide will explore:

If you are evaluating asset digitization, institutional issuance, or blockchain-based financial infrastructure, understanding the fundamentals is critical before engaging a blockchain development agency or evaluating the top blockchain development companies in the market.

The discussion ahead is not promotional. It is structural, regulatory, and infrastructure-focused — because tokenization is not about hype cycles. It is about rebuilding financial plumbing.

Before discussing tokenization, we must clearly answer a foundational question: what is an RWA?

An RWA, or real-world asset, is any tangible or financial asset that exists outside of blockchain networks but holds recognized economic value in traditional markets. These assets are governed by legal contracts, regulatory oversight, custodial arrangements, and centralized recordkeeping systems. In simple terms, RWAs are the backbone of global finance — they represent ownership, income rights, or claims tied to physical or legally recognized instruments.

From a regulatory standpoint, bodies such as the International Organization of Securities Commissions emphasize that assets — whether digital or traditional — must comply with existing investor protection and securities frameworks. This means an RWA is not defined by technology; it is defined by legal enforceability and economic substance.

In legacy finance, ownership of real-world assets is maintained through:

For example, when an investor buys into a private equity fund, their ownership is recorded through fund administrators and legal documentation — not through a real-time, interoperable system. Transfers often require manual approval, updated documentation, and administrative processing.

This creates friction.

One of the defining characteristics of RWAs — particularly in private markets — is illiquidity. Investors in private equity, private credit, or real estate vehicles may be locked in for years. Secondary sales are complex, opaque, and often require issuer approval.

The result?

Understanding what is an RWA therefore also requires understanding why these assets, despite their value, remain structurally constrained.

RWAs span across asset classes that collectively represent trillions in global value:

Each of these assets operates within well-defined legal frameworks but often relies on legacy administrative systems.

The inefficiencies are not due to the assets themselves — but to how ownership and transfers are managed:

These constraints were acceptable in low-rate, capital-abundant environments. However, in today’s high-interest, capital-constrained markets, efficiency matters more than ever. Investors seek yield, liquidity optionality, and operational clarity. Issuers seek faster capital formation and broader access.

RWAs dominate institutional portfolios — but their infrastructure remains outdated.

|

Feature |

Traditional Asset Structure |

Digitally Structured Asset Model |

|

Ownership Records |

Centralized registries |

Blockchain-based ledger |

|

Transfer Process |

Manual approval & paperwork |

Rule-based automated validation |

|

Settlement Time |

Days to weeks |

Potentially near real-time |

|

Transparency |

Limited to administrators |

Immutable audit trails |

|

Investor Access |

Restricted & localized |

Potentially global (regulated) |

In summary, when we ask what is an RWA, we are not simply defining an asset class. We are identifying the foundational building blocks of global finance — assets that generate yield, preserve capital, and anchor institutional portfolios.

The next step is understanding how these traditionally rigid structures can be transformed through programmable infrastructure — and that leads directly into what is RWA tokenization and how it works in practice.

To move beyond theory, we must clearly define what is RWA tokenization in practical and legal terms.

RWA tokenization is the process of converting ownership rights in real-world assets into blockchain-based digital tokens that represent legally enforceable claims. These tokens are not speculative crypto instruments. They are structured representations of assets such as real estate, private credit, private equity, or treasury instruments — issued within regulatory frameworks.

At its core, what is RWA tokenization really about? It is about separating asset ownership from outdated administrative systems and embedding it into programmable infrastructure.

Tokenization does not replace legal ownership — it digitizes it.

The underlying asset remains governed by contracts, corporate structures, and securities law. Typically, an asset is placed within a legal entity (often a Special Purpose Vehicle), and tokens represent shares or units of that entity.

This creates a two-layer model:

The token becomes a digital wrapper around legally recognized ownership.

Smart contracts act as automated rule engines.

Instead of relying solely on manual review or transfer agents, compliance logic can be encoded directly into the token’s architecture. These programmable rules may include:

If conditions are not met, the transfer simply cannot execute.

This shifts compliance from reactive enforcement to automated prevention.

Traditional private markets require significant administrative oversight. Subscription documents must be reviewed. Transfers require approval. Records must be reconciled.

Tokenization introduces embedded compliance:

For institutions exploring broader Blockchain Technology Use Cases, RWA tokenization represents one of the most structurally significant applications — because it integrates legal, financial, and technical infrastructure.

Another major structural shift is fractionalization.

Large assets — such as commercial real estate or private credit portfolios — can be divided into smaller digital units. This:

However, fractional ownership still operates within regulatory boundaries. Tokenization does not eliminate compliance; it embeds it.

Organizations evaluating this infrastructure shift often consult a specialized blockchain development agency to ensure secure contract architecture and regulatory alignment. Choosing among the top blockchain development companies becomes critical when dealing with securities-grade systems.

To clarify further, here is a simplified structural breakdown:

Understanding what is RWA tokenization requires recognizing that this is not a crypto-native concept. It is an evolution of securities infrastructure.

In the next section, we move deeper into mechanics — because to truly grasp rwa tokenization explained, we must examine the technical workflow behind issuance, compliance, and settlement.

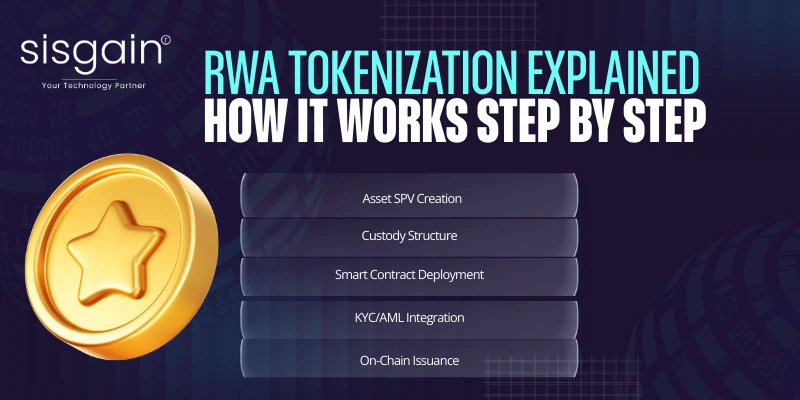

To fully understand rwa tokenization explained, we must examine the operational stack that supports it. Tokenization is not simply minting a digital asset — it is building regulated infrastructure around ownership.

Below is the end-to-end workflow.

Most tokenized RWAs are structured through a Special Purpose Vehicle (SPV). The SPV legally holds the asset, and investors purchase tokenized shares in that entity.

This protects investors and ensures compliance with securities laws.

Custody must be clearly defined:

Institutional-grade tokenization requires independent custodians and transparent asset servicing arrangements.

Once the legal structure is in place, smart contracts are deployed.

These contracts define:

The blockchain used may be:

The choice depends on regulatory comfort and operational requirements.

Before tokens are distributed, investors undergo:

Approved investors are added to a whitelist. Transfers outside this approved list are automatically blocked.

This demonstrates why regulated frameworks matter. Without compliance integration, tokenized assets cannot operate legally in most jurisdictions.

Tokens are minted and allocated to verified investors. Ownership is recorded on-chain, creating:

Investors access a platform interface where they:

Platforms such as Securitize and INX have built regulated environments to facilitate this process.

Each transfer request triggers automated validation:

If rules are not met, the transaction fails.

Compliance becomes architectural — not administrative.

Settlement occurs on-chain, often reducing reconciliation requirements. Every transaction leaves an immutable audit trail, improving transparency for auditors and regulators.

Cap table automation reduces manual errors. Reporting can be generated programmatically.

Tokenization does not remove securities law. It encodes it.

Regulated frameworks ensure:

Without regulatory alignment, tokenization risks becoming structurally unstable.

In summary, rwa tokenization explained reveals a layered infrastructure system — combining legal structuring, blockchain architecture, compliance automation, and regulated trading mechanisms.

The tokenization of RWA is not a cosmetic innovation. It addresses structural inefficiencies that have defined private markets for decades. In an era of rising interest rates, constrained liquidity, and institutional demand for yield precision, infrastructure efficiency is no longer optional — it is strategic.

Traditional RWAs, particularly private equity, private credit, and real estate funds, often lock capital for extended periods. Secondary transfers are possible but operationally complex.

The tokenization of RWA introduces liquidity optionality. It does not guarantee deep liquidity, but it enables programmable transfer mechanisms within regulated environments. This reduces friction in ownership changes and creates potential for structured secondary venues.

Liquidity becomes more modular rather than binary.

Large-scale assets historically required high capital commitments. Tokenization allows fractional ownership, enabling:

For institutions, this enhances capital efficiency. For asset managers, it expands distribution flexibility.

Legacy settlement processes rely on intermediaries, reconciliation cycles, and manual record updates. In contrast, blockchain-based settlement can provide:

While regulatory requirements remain intact, settlement friction is materially reduced.

Every transaction recorded on a blockchain generates an immutable audit trail. This enhances:

Instead of relying on siloed systems, tokenized infrastructures consolidate transaction history into a single verifiable ledger.

Global capital allocation is often restricted by administrative complexity and jurisdictional barriers. When compliance rules are encoded into smart contracts, cross-border participation can be managed more efficiently.

This does not eliminate regulatory fragmentation — but it enables programmable enforcement at scale.

Manual cap table management, subscription processing, transfer approvals, and reconciliation cycles create operational drag. Tokenized systems automate much of this workflow, reducing administrative overhead while improving data consistency.

The tokenization of RWA is gaining traction at a time when:

In high-rate environments, capital efficiency becomes critical. Asset managers seek operational structures that reduce cost leakage while preserving regulatory compliance.

Tokenization aligns with this macroeconomic shift.

The conversation around tokenized assets is no longer theoretical. Institutional adoption signals are becoming increasingly visible.

Short-duration government securities have emerged as early leaders in tokenization. Tokenized treasury products provide:

These instruments appeal to institutions seeking stable yield within digital settlement frameworks.

Private credit markets — already expanding globally — are increasingly being structured through tokenized vehicles. The appeal lies in:

Private credit’s predictable cash flow characteristics make it particularly adaptable to programmable infrastructure.

Commercial and income-generating properties are natural candidates for tokenization due to:

Fractional real estate tokenization enables diversified exposure while reducing entry barriers.

Large financial institutions exploring blockchain-based asset structures provide credibility to the sector.

For example, BlackRock has explored tokenized fund structures within regulated frameworks. Similarly, JPMorgan Chase has developed blockchain-based settlement initiatives to streamline financial transactions.

These are not speculative experiments — they represent infrastructure research and deployment by globally significant institutions.

Despite growth, liquidity depth remains uneven. Many tokenized RWAs still operate in controlled environments with limited secondary activity.

Challenges include:

Institutional validation is growing, but liquidity maturity remains a developing layer of the ecosystem.

Any serious discussion of tokenization must begin with regulatory clarity. Tokenization does not operate outside the law — it operates within it.

Authorities such as the U.S. Securities and Exchange Commission have consistently emphasized that digital representations of securities remain subject to existing regulatory frameworks.

If a token represents ownership, debt claims, or investment contracts, it is generally classified as a security. This triggers:

The digital format does not alter the legal classification.

Custody arrangements must comply with jurisdictional regulations. This includes:

Institutional investors require clarity around asset protection and insolvency frameworks.

Anti-money laundering (AML) regulations apply regardless of blockchain architecture. Tokenized platforms must integrate:

Compliance automation enhances enforcement — but does not replace legal obligations.

Different jurisdictions impose varying rules regarding:

Smart contracts can encode these restrictions directly into transfer logic, ensuring non-compliant transactions are automatically rejected.

Tokenization does not remove regulation — it encodes it.

Compliance becomes part of the infrastructure rather than an external review layer. This architectural integration is critical for long-term institutional adoption.

To understand the durability of tokenized systems, we must examine the full infrastructure stack. Tokenization is not just about issuing digital tokens — it is about integrating multiple technical and legal layers.

This is the foundational ledger where transactions are recorded. It may be:

Each offers different trade-offs in scalability, transparency, and governance.

Smart contracts define:

Security audits and formal verification become critical at this layer.

Middleware integrates:

This ensures that regulatory requirements are enforced before transactions are finalized.

Custodial systems safeguard:

Institutional-grade custody is essential for risk mitigation.

Regulated platforms facilitate compliant transfers between approved investors. These environments maintain:

Automated reporting tools generate:

This reduces administrative overhead while enhancing transparency.

When evaluating Blockchain Technology Use Cases, RWA tokenization stands out because it integrates legal, financial, and technical infrastructure into a unified system.

Organizations seeking to deploy such systems typically engage a specialized blockchain development agency capable of designing secure contract architectures and regulatory-compliant workflows. Selecting from the top blockchain development companies requires evaluating not just coding ability, but financial infrastructure expertise.

Tokenization is not merely software development. It is financial engineering supported by secure digital architecture.

A credible discussion of tokenization must acknowledge its constraints. While the infrastructure is promising, RWA tokenization is still evolving — and several structural risks remain.

One of the most cited advantages of tokenization is improved liquidity. In practice, however, liquidity can become fragmented across multiple platforms and jurisdictions. Without consolidated secondary venues and active market makers, tokenized assets may trade in limited volumes. Liquidity optionality exists — but deep, consistent market depth is not yet universal.

Custody remains a foundational concern. While blockchain enables transparent ownership records, the safeguarding of private keys, digital wallets, and underlying asset documentation introduces new operational risks. Institutional-grade custodians mitigate these risks, but infrastructure maturity varies across markets.

Smart contracts are powerful rule engines — but they are also code. Coding errors, logic flaws, or inadequate audits can expose tokenized systems to vulnerabilities. Once deployed, modifying smart contracts can be complex, depending on architecture. Rigorous security audits and formal verification processes are essential.

Regulatory clarity is improving, yet policy frameworks continue to evolve. Changes in securities classification, cross-border restrictions, or custody regulations could impact tokenized structures. Issuers must design adaptable compliance architectures to navigate potential regulatory shifts.

Institutional investors demand stability, predictability, and legal enforceability. While blockchain improves transparency, trust is built through regulatory alignment, reputable custodians, and operational resilience. Tokenization must prove its durability through consistent performance — not marketing narratives.

Many tokenized markets remain early-stage. Limited trading activity can result in price discovery challenges. Until institutional participation broadens, market depth may remain uneven across asset categories.

A balanced perspective recognizes that tokenization is infrastructure under construction — not a finished system.

Looking ahead, the next five years are likely to determine whether tokenization becomes a foundational pillar of capital markets or remains a niche financial layer.

As regulatory frameworks mature and custody standards solidify, institutional onboarding is expected to accelerate. Asset managers, private credit funds, and structured finance vehicles are increasingly exploring tokenized issuance models. The shift will likely be incremental but steady.

Stablecoins may play a growing role in facilitating settlement and distribution within tokenized ecosystems. By providing programmable, on-chain liquidity rails, stablecoins can reduce friction in capital deployment and income distribution.

Fragmentation remains a constraint. Future development will likely focus on interoperable platforms that allow compliant transfers across regulated ecosystems. Cross-platform communication standards could enhance liquidity aggregation while preserving jurisdictional controls.

Compliance automation will evolve beyond static rule sets. Future systems may integrate dynamic regulatory updates, AI-assisted monitoring, and automated reporting pipelines. This will strengthen regulatory confidence and reduce administrative burden.

The broader trajectory points toward gradual digitization of capital markets infrastructure. Tokenization may coexist alongside traditional systems before eventually integrating more deeply into clearing, settlement, and fund administration processes.

The key insight is this: tokenization is not attempting to replace finance — it is modernizing its operational core.

From 2026 to 2030, success will depend less on technological novelty and more on regulatory clarity, institutional discipline, and infrastructure resilience. Those who approach tokenization as financial engineering — rather than speculative experimentation — will shape the next phase of market evolution.

Real-world assets are not a passing narrative. They represent the foundation of global capital markets — from real estate and private credit to treasury instruments and structured funds. The growing conversation around their digital transformation is not speculative hype. It reflects a structural reassessment of how ownership, compliance, and settlement should function in modern financial systems.

Tokenization is best understood as infrastructure evolution.

It does not eliminate legal frameworks. It does not bypass regulation. And it does not automatically create liquidity. Instead, it embeds compliance into programmable systems, enhances transparency through immutable records, and introduces liquidity optionality within controlled environments.

Compliance remains core.

Any sustainable model for tokenized RWAs must align with securities law, custody standards, AML requirements, and jurisdictional restrictions. Technology strengthens financial systems only when it respects regulatory architecture — not when it attempts to circumvent it.

Liquidity optionality also matters. Even if market depth is still developing, the ability to structure compliant secondary pathways represents a meaningful shift from rigid, lock-in models that have defined private markets for decades.

Institutions are not rushing — they are entering cautiously, testing frameworks, validating custodial models, and integrating blockchain infrastructure incrementally. That steady, disciplined adoption is often a stronger signal than speculative acceleration.

For organizations evaluating RWA issuance, digitization, or regulated token infrastructure, the critical question is not whether tokenization is viable — but how to architect it responsibly.

Strategic consultation around RWA infrastructure planning — from legal structuring to smart contract design and compliance integration — is essential for long-term durability in this evolving market landscape.

Project quotes, partnerships, implementation

Open roles, referrals, campus hiring